Best rental yields in Portugal: from north to the Algarve

Buying real estate in Portugal? Find out what is a good rental yield.

Best rental yields in Portugal. Investing in another country can be a daunting task, especially if it’s the first time. However good investment returns – and some force majeure visits to sunny Portugal, can justify the time-consuming property buying processes.

Surrounded by the sea, blessed by the sun, and also with some peaceful mountainous areas, Portugal is a country that still offers some of the best rental yields in Europe, next to an enviable quality of life.

You can calculate now how much a specific property could be generating by using our calculator below, and you can continue reading this article to find out more about the buying process or expected returns for your next real estate investment in Portugal.

Table of contents

1. Where is the best place to buy property in Portugal?

Loaded with traditions, Portugal is a country of slow and steady development. Its cities’ downtowns are filled with stone buildings and beautiful stucco ceilings.

In the countryside and rural areas, it is still possible to find old typical houses, also made from stone, with cute framed windows, and picturesque details. Sea front properties and luxury resorts are also on the list.

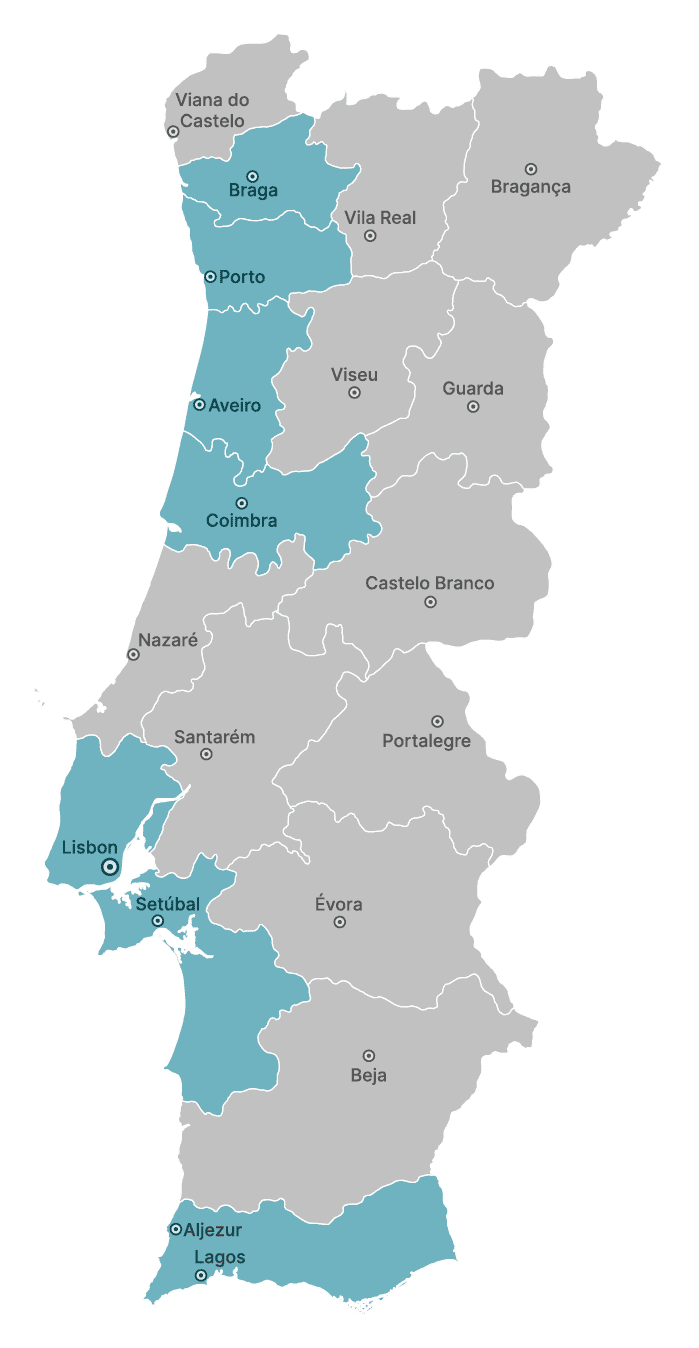

In Portugal, the regions with higher prices are located in the Lisbon area and in the Algarve. In the northern regions, it is possible to find lower prices per square meter.

In a very broad way, regions with higher prices produce a lower average income and regions with lower prices produce higher income.

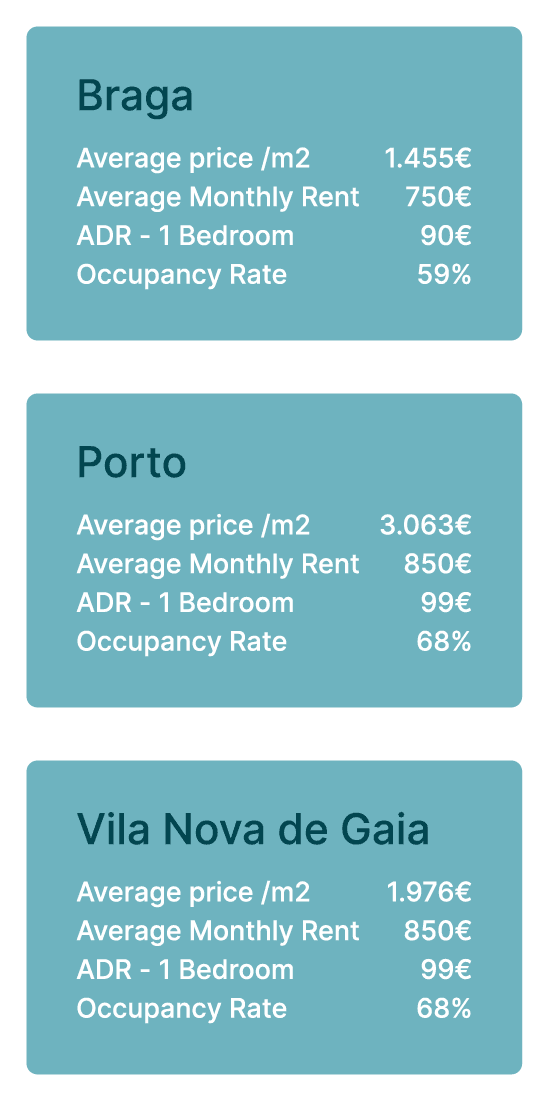

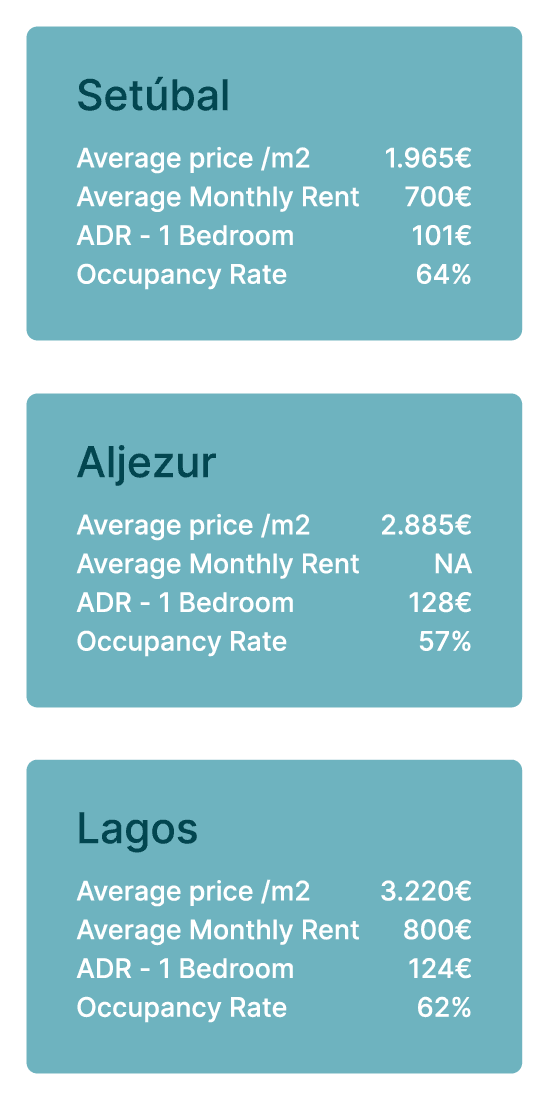

Here are some cities worth investing in, where you will be able to find Portugal’s best rental yields. Let’s get into numbers.

Buy to let Braga

- 7.2% annual yield

- 1.455€ Average price per m2

Braga is an emergent Portuguese city, with a thriving buy-to-let market thanks to international schools, tech hubs, tourism, and student population.

Here investors can earn back 7.2% in their first and second years. It’s a good time to invest in property in the north.

Buy to let Porto

- 4.3% Annual yield

- 3.063€ Average price per m2

The second biggest city of Portugal is located in the north and is known for having more affordable prices than Lisbon. Although prices have been growing, with some research and luck it is still possible to find very attractive yields.

Demand is high and the best buy to let areas in Porto can be found outside the city centre.

Buy to let Vila Nova de Gaia

- 6.1% annual yield

- 1.976€ Average price per m2

Located right next to Porto, and known for its Porto wine Cellars, Gaia is a big city with a lot of potentials, depending on the area.

The price per sqm is significantly lower here, but its proximity to Porto’s downtown ensures that your investment is worth and viable.

Buy to let Aveiro

- 5.0 % annual yield

- 2.272€ Average property price

Called the “Venice of Portugal”, Aveiro is a coastal city with picturesque colourful houses, tech hubs emerging and tourism boosting. The price of the square meter has risen in recent years but is still lower than in Lisbon and Porto.

The University of Aveiro is also famous in the country and several technology hubs have settled in the city, increasing the demand for housing.

Buy to Let Coimbra

- 5.8% annual yield

- 1.582€ Average price per m2

Famous for its academic tradition, Coimbra is the 3rd biggest city in Portugal. It holds the oldest Portuguese university, so landlords can expect to have their properties always rented.

Buy to let Lisbon

- 2.9% annual yield

- 5.000€ Average price per m2

Lisbon has been ranked as the 3rd most expensive city in Europe, after London and Rome. Investing in property in Lisbon is indeed a safe investment, as you can easily rent or sell, but the rental yield in Lisbon will not soon be as high as in other Portuguese cities.

Buy to let Setúbal

- 6.3% annual yield

- 1.965€ Average property price

Still pretty much anonymous, but on the verge of huge display and massive development is Setúbal. Located right across the banks of the Tagus River, Setúbal areas are known for their low price per sqm.

However, it’s a district of contrasts, and here you will also find some of the most expensive luxury resorts in Portugal, because of its amazing beach areas of Portugal, like Serra da Arrábida, Tróia, and Comporta.

Buy to let Algarve

- 3.3% annual yield

- 2.950€ Average price per m2

The Algarve is still the preferred destination for UK and German tourists and expats. If you plan to buy property in the Algarve, check locations such as Aljezur, Faro, or Lagos. Demand is not as high as in other Portuguese cities.

Here’s a graphic table with information on both long-term leases and short-term rentals in each Portuguese city mentioned above.

2. What is a good rental yield in Portugal?

A good rental yield is anywhere between 5% and 8%.

It is important that your rental income covers the running costs of the property, and if you decide to do a short-term rental, you should be aware that the expenses of the business are high.

The costs of the property include mortgage payments, wear and tear – which is significantly higher when doing long-term rental, and any other rental expenses.

Business costs when doing short-term rental include maintenance, cleaning, décor, towels, and linen.

A solid return on investment plan will avoid drawing on your contingency fund.

If you’re planning to invest in real estate in Portugal, there are still many opportunities to find in the market either for the long-term or short-term. Golden Visa investments in short-term rentals are still possible in high-density areas in 2022.

3. Why buy property in Portugal?

Investing in the real estate market in Portugal has been something attractive to many investors, also because of its ARI – Residency through investment.

The Golden Visa has brought many worldwide investors to buy real estate in Portugal, with over 90% of investments made in real estate.

In the past years, the market has gone through several ups and downs, but demand continues to rise. The offer in the real estate market is varied, ranging from old-style flats in the city centres, beach houses, picturesque houses in the countryside, or luxury resorts.

The low cost of living and the high quality of life have put Portugal in the sights of foreign investors, particularly due to the growth in tourism in the main cities, and inflation has not discouraged them. Even with the latest financial crisis, the prices keep going up.

4. Is buying property in Portugal a good investment?

Buying property in Portugal is a good investment. The coronavirus did not stop the real estate market, it actually contributed to its growth.

Portugal is being sought by many investors, digital nomad families, and retirees from many countries in the world. However, like any other real estate investment, there are some factors to have in mind before investing in real estate in Portugal, and to keep it safe you should:

- Hire a real estate agent

- Check the services and industry around the investment you intend to buy.

- Check if the property comes with any debt

- Hire a lawyer for the deed

5. Can foreigners buy property in Portugal?

Foreigners can buy property in Portugal and can have a special tax regime if they did not have residency in Portugal in the 5 previous years. Plus, foreigners can also buy a house in Portugal through the Golden Visa program and obtain citizenship.

6. What is the tax on rental income in Portugal?

Portugal residents pay tax on rental income at a flat rate of 28%. Expenses and additional taxes related to the property are deductible. If you plan to open a short-term rental business, the taxes are VAT 6%, and 20% (if you’re a non-habitual resident) on 35% of the taxable amount – this percentage is considered profit. The other 65% are considered expenses and they are not taxed.

Long, mid, or short-term?

Again, during the pandemic, the short-term rental market in Portugal changed. People that can work from home, can also work from anywhere else. Because of this, they prefer to work in a place where they can have access to outdoor spaces and nice weather.

The line between these 3 different rental types is getting thinner – people prefer the flexibility of a mid-term contract and the comfort of a fully furnished apartment. As people travel more and stay longer, mid-term reservations have been high since 2020.

At the same time, this reality is bringing massive change to the demographics of the country as people are looking for a better quality of life and more affordable prices in different locations than the city’s centres.

While some prefer to travel long-term and have mid-term stays in different places, others prefer to buy and invest in smaller cities or even villages, making these other places as attractive as the main cities. Where demand increases, investment goes, right?

Invest in any city in Portugal with GuestReady

Although tourism in Portugal did suffer a major break in 2020, short-term rental businesses are coming back to life. We can already see a massive turning point in the occupancy rates at the beginning of 2022 and with its summer peak.

The Portuguese real estate market has never been so dynamic making property investments very attractive.

With services that include posting ads, hosting guests and cleaning the flat, there is no reason to hesitate to maximise rental returns via Airbnb so let us help you on this profitable journey.